VIU Advisory – Hero Statement

Capital without compromise.

We unlock tailored financing, insurance, and wealth solutions for corporations, investors, and sovereigns—backed by a decade of proven deal execution across the globe.

Our Mission

To serve as a trusted, conflict-free adviser—providing deep expertise in Capital Raising, International Insurance, and Wealth Management. We deliver innovative, strategic answers to complex financing challenges for corporates, private-equity sponsors, hedge funds, family offices, ultra-high-net-worth individuals, and government entities.

Advisory Model

VIU Advisory “Independent. Insight-Driven. Execution-Focused”.

-

Authorized Intermediary: Mandated by premier private-capital sources worldwide.

-

Solution Architects: We customize structures banks and traditional lenders decline.

-

Negotiation Powerhouse: We secure terms that align with each client’s unique objectives—cost, tenor, covenants, and speed of execution.

We are not a brokerage—our mandate is representation at the highest consulting standard.

Vision & Values

-

Integrity-First: Independent counsel, free of product bias.

-

Diligence-Driven: For every engagement we conduct rigorous financial, legal, and commercial analysis—protecting our clients in every clause.

-

Industry Stewardship: We elevate private funding standards by filtering out unqualified intermediaries and ensuring professional discipline throughout each transaction.

I. Product Suite

| Capital Solution | Use Cases | Typical Ticket Size* |

|---|---|---|

| Trade Finance | Pre- & post-shipment working capital | €/USD10-100 MM |

| Corporate & Project Finance | Growth, greenfield, brownfield | €/USD25-500 MM |

| Equipment Finance | CAPEX, leasebacks | €/USD10-250 MM |

| M&A / Acquisition Finance | Leveraged buyouts, roll-ups | €/USD25-500 MM |

| Asset-Based Lending | Inventory, receivables, real assets | €/USD10-300 MM |

| Structured Commodity Finance | Off-take, tolling, warehouse receipts | €/USD20-400 MM |

*Indicative ranges. Larger mandates considered.

VIU Risk Solutions: Protecting Your Capital and Your Team

“VIU Risk Solutions – Protecting the people behind the deal.”

At VIU Advisory, we believe true capital strategy includes risk management. As your projects expand across borders, safeguarding your people, cash flow, and legacy becomes essential to long-term success.

Through our strategic insurance solutions, we protect the human capital behind your transactions and investments, giving you the confidence to execute without compromise.

What We Offer?

✅ International Healthcare Insurance

Access tier-one healthcare globally for executives, founders, and families.

✅ Executive Travel Insurance

Emergency medical, evacuation, and trip protection for cross-border teams.

✅ Term-Life Insurance

Protect key persons and succession plans with global term-life cover.

✅ Income Protection

Secure your earnings if illness or injury interrupts your business or leadership role.

Why It Matters?

-

Protect your project timelines and deal teams during cross-border execution.

-

Preserve wealth and operational continuity if health issues arise.

-

Ensure your family and partners are covered while you focus on growth.

-

Align your insurance with your capital strategy for true resilience.

II. Expanded Product Suite “VIU Risk Solutions”

|

Core Benefit | Primary Audiences | Proof / Feature Highlights |

|---|---|---|---|

| International Healthcare | Ongoing access to tier-one care anywhere in the world | C-suite expatriates, PE portfolio execs, HNW families | Three global cover zones; 4-step instant quote wizard |

| Global Travel | Trip cancellation, medical evacuation & liability protection | Investment teams, site-visit consultants, EPC staff | Single-, one-way or annual cover; Trustpilot-rated provider |

| Term-Life | Lump-sum payout that secures family & shareholder continuity | Founders, key-person executives, buy-sell partners | Quick-quote form captures smoker status, country of residence & salary to tailor premiums |

| Income Protection | Replaces up to 80 % of salary if illness/injury halts earning capacity | Project managers, contractors, expatriate professionals | Multi-step wizard vets occupation, travel, medical history; selectable waiting periods |

“From medical care to income security—VIU Risk Solutions protects people and cash-flow behind every transaction.”

Get a Custom Quote

└── VIU Risk Solutions 4 step instant product quote* in blue underneath

├── Health (Medical)

├── Travel (Trip & Evacuation)

├── Life (Term-Life)

└── Earnings (Income Protection)*Quotes are confidential, fast, and tailored to your unique needs.

“Insurance products underwritten by SiriusPoint Intl. Delegated authority: Expatriate Healthcare Ltd. (FCA 580545).”

Fee Philosophy

Professionalism commands value. We operate on a transparent, engagement-based fee model—initiated only after an internal project review confirms feasibility. Our clients are sophisticated principals who recognize that expertly architected capital solutions require up-front investment. All counterparties are onboarded under VIU’s KYC/AML Policy, which applies FATF-aligned ID verification, sanctions screening, and ongoing transaction monitoring before any fees are charged.

“VIU applies a risk-based KYC/AML framework that fully implements the 40 FATF Recommendations, including ID/document verification, global sanctions & PEP screening, and continuous transaction monitoring.”

Global Reach

We originate and execute multi-million-euro or us dollar transactions on every continent—excluding Afghanistan, Iraq, Yemen, and North Korea—leveraging a network of institutional lenders, insurers, and investors.

Strategic Partnership: VIU × M&A World Powered by Mandaworld

Unlocking cross-border deal flow through a 550-advisor network.

What it means for our clients

Global Investor Access – Direct reach to 45,000+ pre-qualified investors in 125+ countries for faster capital raises and wider exit options.

Deal-Closing Velocity – Proprietary IT platforms and a 200-seat Business Support Center compress diligence timelines—cutting average deal closure by up to 40 %.

On-the-Ground Expertise – 550+ senior M&A professionals provide region-specific legal, tax, and regulatory insight so structures land right the first time.

Matchmaking Technology – AI-powered “Smart Agent” scans both VIU and M&A World pipelines to surface ideal buyers, sellers, and co-investors in real time.

How we activate the partnership

Dual Mandate Option – Clients can elect a co-branded VIU / M&A World mandate, gaining immediate platform visibility without extra retainers.

Enhanced Data Rooms – Transactions are hosted on M&A World’s secure Project-Manager platform—integrated into VIU’s deal dashboard for single-sign-on.

Quarterly Deal Forums – Joint pitch events rotate across Ottawa, Budapest, and Dubai, giving VIU clients live access to global capital.

Result: more buyers, sharper valuations, quicker closes—delivered under one unified advisory umbrella.

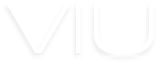

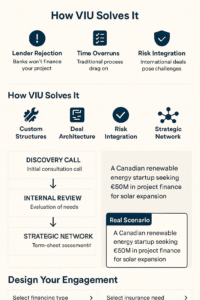

Raising Capital—Reality & Relief

The funding journey is resource-intensive, opaque, and often costly. Common pitfalls:

-

Time & Budget Overruns

-

Confidentiality Leakage

-

Unequal Capital (not all money is strategic)

-

Investor Fatigue

-

Legal Complexity

Our Edge: We compress timelines, safeguard sensitive data, curate capital sources, and negotiate market-beating terms—guided by a decade of transaction expertise.

Why VIU?

| Your Challenge | Our Response |

|---|---|

| Capital shortfall or lender rejection | Bespoke structures sourced from private capital pools |

| Complex cross-border risk | Integrated legal & commercial due diligence |

| Rapid execution required | Streamlined mandate process; senior-level attention |

| Need for long-term partner | Relationship mindset—beyond a single transaction |

Ready to Execute?

Step 1: Discovery Call – Assess objectives and constraints

Step 2: Internal Review – Feasibility, alignment, mandate proposal

Step 3: Engagement & Diligence – Formalize scope, initiate structuring

Step 4: Capital Delivery – Term-sheet negotiation through closing and funding

Case Studies

For Discovery call: (+1) 819-200-2455

VIU Advisory – Capital delivered with precision, integrity, and impact.